Vancouver, BC: Homerun Resources Inc. (“Homerun” ou a “Empresa”) (TSXV: HMR) (OTCQB: HMRFF) is pleased to announce that, further to the news release dated October 9, 2024, detailing a non-brokered private placement of up to 769,231 units for aggregate gross proceeds of up to $1,000,000, the Company has today increased the financing to up to 1,659,977 units for aggregate gross proceeds of up to $2,157,970.

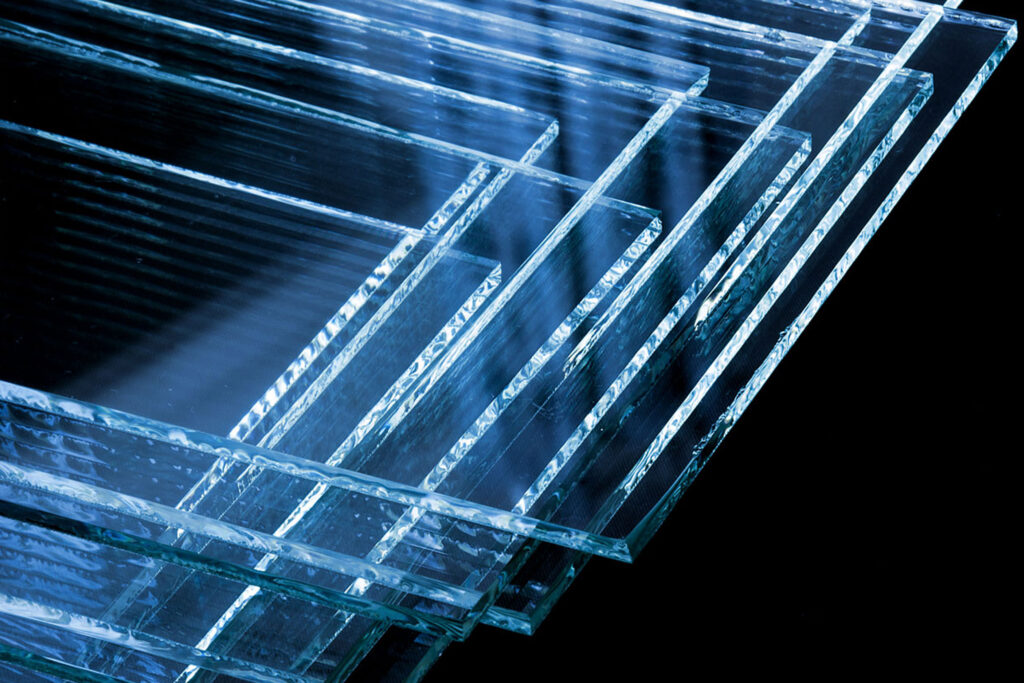

Each unit is priced at $1.30 and consists of one common share of the company and one common share purchase warrant with each warrant being exercisable for an additional common share at an exercise price of $2.00 for 24 months. The warrants will be subject to the right of the company to accelerate the exercise of the warrants if the shares of the company trade at or above $3.00 for a period of 10 consecutive trading days. Finders’ fees in accordance with TSX Venture Exchange policies may apply to the financing. All securities issued pursuant to the financing will be subject to a four-month hold. Proceeds from the financing will be used for general working capital and for the continuing development of the company’s HPQ silica projects within the global energy transition.

Homerun Resources CEO Brian Leeners stated: “We are delighted with the immense support shown by new and existing shareholders for our recently announced financing. We will no longer be accepting subscriptions and will be working through the closing process immediately. Over the past 18 months, our team has executed the Company’s communicated strategic plan with a focus on capital efficiency. This new capital will allow Homerun to achieve its near-term strategic initiatives and result in the continuing creation of value for the long-term shareholders of the Company.”

Related Party Participation in the Offering

Certain insiders of the Company expect to participate in the Offering. The participation by insiders in the Offering constitutes a “related party transaction” as defined under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101“). The Company is relying on the exemptions from the valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101, as neither the fair market value of the securities purchased by insiders, nor the consideration for the securities paid by such insiders, will exceed 25% of the Company’s market capitalization. The Company expects that closing of the Offering will occur within 5 business days of this announcement and that it will not file a material change report in respect of the related party transaction at least 5 days before the closing. The Company deems this circumstance reasonable in order to complete the Offering in an expeditious manner. The Offering has been unanimously approved by the Company’s board of directors. Further information regarding the interest in the Offering of every related party and the effect that the Offering will have on their percentage of securities of the Company will be provided once finalized.

Sobre os recursos do Homerun (https://homerunresources.com/)

Homerun is focused on the development of industrial materials and technologies that will contribute to meeting the world’s clean energy and climate goals. The Company is listed on the TSX Venture Exchange under the symbol HMR.

Em nome do Conselho de Administração da

Recursos Homerun Inc.

“Brian Leeners”

Brian Leeners, CEO e Diretor

[email protected] / +1 604-862-4184 (WhatsApp)

PARA A ADEQUAÇÃO OU PRECISÃO DESTE LANÇAMENTO

As informações aqui contidas contêm “declarações prospectivas” na acepção da legislação de valores mobiliários aplicável. As declarações prospectivas referem-se a informações baseadas em suposições da administração, previsões de resultados futuros e estimativas de valores ainda não determináveis. Quaisquer declarações que expressem previsões, expectativas, crenças, planos, projeções, objetivos, suposições ou eventos ou desempenho futuros não são declarações de fatos históricos e podem ser “declarações prospectivas”.

Neither the TSX Venture Exchange nor its Regulation Services Provider

(as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.