News Release Highlights:

- Homerun has now secured ownership and supply agreements covering the entire Santa Maria Eterna Silica Sand District.

- The new Pedreiras concession is fully permitted with a low royalty rate of R$ 30.17 per extracted tonne.

- The Pedreiras concessions have been drilled to a depth of 8 metres with a 32 million tonne resource filed at the Agência Nacional de Mineração (ANM).

- The Company’s target resource under the three CBPM Lease acquisitions now exceeds 200 million tonnes.

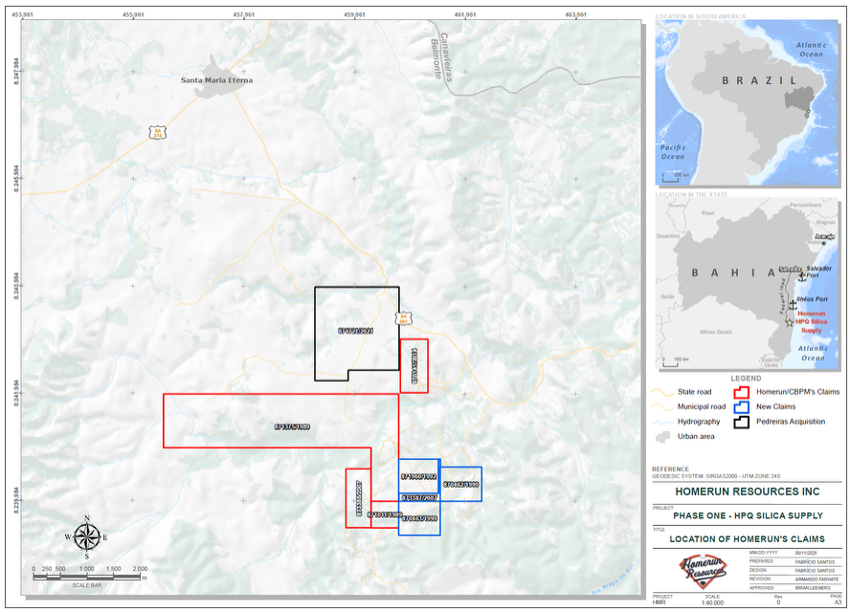

Vancouver, B.C.—Homerun Resources Inc. (“Homerun” or the “Company”) (TSXV: HMR; OTCQB: HMRFF) is pleased to announce it has signed a binding Letter of Intent (LOI) with Pedreiras do Brasil S.A. (“Pedreiras”) a company controlled by Vitoria Stone, dated September 10, 2025, securing the rights to exploit the Pedreiras mining tenement (871.721/2021, 246.36 hectares) at the Santa Maria Eterna Silica Sand District in the municipality of Belmonte, Bahia, Brazil, granted under a lease agreement with Companhia Bahiana de Pesquisa Mineral (CBPM).

This LOI enables Homerun to acquire all exploitation rights and obligations currently held by Pedreiras under the CBPM Lease, on a measured resource of 32 million tonnes (auger drilled to 8 metres) filed at the ANM and is fully permitted with a royalty payment to CBPM of R$30.17 per extracted tonne. (the “Acquisition”).

This is now the third CBPM lease acquisition by Homerun marking a significant step in the continuing strategic plan to consolidate control over the Santa Maria Eterna Silica Sand District. By controlling the district, Homerun secures uninterrupted access to a unique large-tonnage high-purity silica sand district, solidifying supply chains, enabling a competitive advantage in vertical integration, achieving pricing power and removing market competition. It also strengthens Homerun’s position when seeking funding or strategic partners as the Company can offer certainty of secure long-life supply and scale. The Company’s target resource over the areas of the three acquisitions now exceeds 200 million tonnes, including a current NI 43-101 mineral resource estimate of 63 million tonnes. This strategic consolidation has been achieved for total capital outlay of US$2.1 million, a fraction of the implied value based on the US$150 per tonne transfer price for the planned primary use-case in the Company’s Solar Glass Manufacturing facility which is being built next to these resources.

Brian Leeners, CEO of Homerun stated, “This marks a major milestone for Homerun. With complete district control secured through acquisition and supply agreements, we are now positioned to unlock the full potential of Santa Maria Eterna. Our team has delivered this consolidation with minimal capital, laying the foundation for significant value creation as we advance towards production. We want to thank our management team for this effort in strategically building significant asset value for Homerun and its shareholders”

The transaction will be settled with US$1,200,000 in Homerun common shares (valued at CA$1.00 per share) and US$200,000 in share purchase warrants (exercisable at CA$1.00 per share). The issuance of the Homerun common shares and warrants will be subject to standard director, shareholder and regulatory approvals and specifically the approval of the TSX Venture Exchange. The Homerun common shares issued under the terms of this agreement will be subject to a standard 4-Month statutory hold period. Pedreiras agrees to contact Homerun regarding the sale of any Homerun common shares and also agrees to limit the sale of the Homerun common shares in any given month to 100,000 if required to sell.

Figure 1: location of existing Homerun controlled claims via CBPM Lease Agreement (red and blue), supply partnership claims via Supply Agreements (green) and the new claims under the Pedreiras Agreement (in black).

Sobre Homerun (www.homerunresources.com)

A Homerun (TSXV: HMR) é líder em materiais verticalmente integrados, revolucionando soluções de energia verde por meio de tecnologias avançadas de sílica. Como uma força emergente fora da China para inovação em sílica de quartzo de alta pureza (HPQ), a empresa controla toda a vertical industrial, desde a extração de matéria-prima até soluções de última geração em energia solar, baterias e armazenamento de energia. Nossa estratégia de integração vertical bimotor combina:

Materiais Avançados Homerun

- Utilizing Homerun’s robust supply of high purity silica sand and quartz silica materials to facilitate domestic and international sales of processed silica through the development of a 120,000 tpy processing plant.

- Pioneirismo em purificação termoelétrica sem desperdício e tecnologias avançadas de processamento de materiais com a Universidade da Califórnia – Davis.

Soluções de energia Homerun

- Building Latin America’s first dedicated high-efficiency, 365,000 tpy solar glass manufacturing facility and pioneering new solar technologies based on years of experience as an industry leader in developing photovoltaic technologies with a specialization in perovskite photovoltaics.

- Líder europeu em marketing, distribuição e vendas de soluções de energia alternativa nos segmentos comercial e industrial (B2B).

- Comercialização de soluções de sistemas de gerenciamento e controle de energia com inteligência artificial (IA) (hardware e software) para captura de energia, armazenamento de energia e uso eficiente de energia.

- Parceria com o Departamento de Energia dos EUA/NREL no desenvolvimento do sistema de armazenamento de energia duradouro e de longa duração, utilizando a areia de sílica de alta pureza da empresa para arbitragem de calor e eletricidade industrial e purificação complementar de sílica.

With multiple profit centers built within the vertical strategy and all gaining economic advantage utilizing the Company’s HPQ silica, across, solar, battery and energy storage solutions, Homerun is positioned to capitalize on high-growth global energy transition markets. The 3-phase development plan has achieved all key milestones in a timely manner, including government partnerships, scalable logistical market access, and breakthrough IP in advanced materials processing and energy solutions.

A Homerun mantém um compromisso intransigente com os princípios ESG, implantando as tecnologias de produção mais limpas e sustentáveis em todas as operações, beneficiando ao mesmo tempo as pessoas nas comunidades onde a Empresa opera. À medida que avançamos na geração de receitas e na integração vertical em 2025, a Empresa continua a proporcionar valor aos acionistas através da execução estratégica no âmbito da imparável transição energética global.

Em nome do Conselho de Administração da

Recursos Homerun Inc.

“Brian Leeners”

Brian Leeners, CEO e Diretor

[email protected] / +1 604-862-4184 (WhatsApp)

Tyler Muir, Relações com Investidores

[email protected] / +1 306-690-8886 (WhatsApp)

PARA A ADEQUAÇÃO OU PRECISÃO DESTE LANÇAMENTO

As informações aqui contidas contêm “declarações prospectivas” na acepção da legislação de valores mobiliários aplicável. As declarações prospectivas referem-se a informações baseadas em suposições da administração, previsões de resultados futuros e estimativas de valores ainda não determináveis. Quaisquer declarações que expressem previsões, expectativas, crenças, planos, projeções, objetivos, suposições ou eventos ou desempenho futuros não são declarações de fatos históricos e podem ser “declarações prospectivas”.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.